|

Fair Labor Standards Act.-

|

In 1996 the minimum wage was $4.75 an hour. Effective September

1, 1997, it was increased to $5.15

Covered non-exempt workers are also entitled to overtime pay (at a

rate of not less than 1.5 times their regular rates, when more than 40 hours of work in a

week).

I am not aware of any increase on the labor minimum wage since 1997 (at the

Federal level). Although I know that since then some States have passed their own

minimum wage standards.

I do not

believe the Federal Labor Standards are "fair". If elected I

would immediately propose a raise in those standards to the "Hawaii"

level, that is: $5.75 starting Jan.1, 2001, and $6.00 starting on Jan.1,

2003.

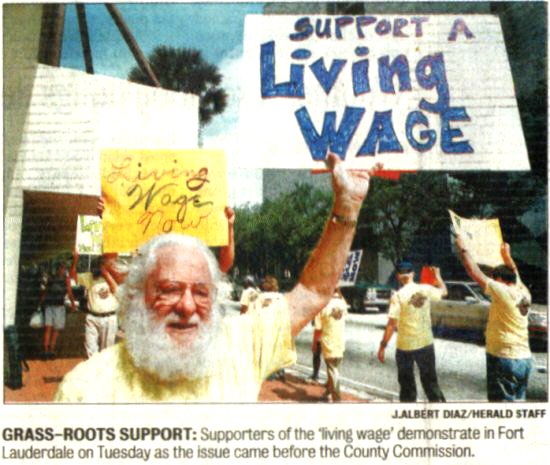

I promise I

will continue fighting for a "living wage" standard of

$10 per hour for a family of four (either direct salary, or

federally subsidized "family points", as done in Europe.

|

|

| I do not want to be labeled as anti-business, and I do

not have any intention of antagonizing any employer. But

-please- stop for a second, and think. Even if we were to implement

in Jan.1, 2003 the "generous" rate of Hawaii at $6.00, that would

represent $240 per week (based on 40 hours a week), or just -barely- $1,000

per month. |

| How many out there can pay rent,

and feed a family with $1,000 a month? In most

cities -these days- you can not even rent a decrepit house for less than

$600. |

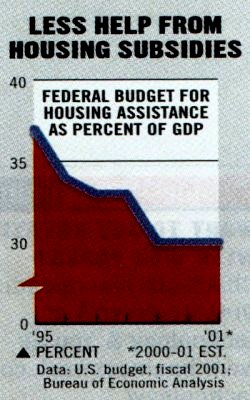

| If we can not pay a higher wage, then it is a must

that we increase housing subsidies, and lower our food-stamps

qualifications. And yet, as it can be seen on a graph

below, the percent of the GDP allocated to housing assistance has

been going down consistently during the last decade. Do we

want riots in the street, for us to be fair with the poor? |

| In polls most Americans have said that, people

who work full-time should be able to earn enough to keep their

families out of the poverty level. But, even after

the adjustments are made to account for the . But, even after

the adjustments are made to account for the Earned-Income

Tax Credit, the minimum wage comes to $7.21. |

| According the to Census Bureau, in order to

keep a family of two adults and two children out of poverty you need

$8.21 (so called living wage).

And only 75% of the workforce meets this minimum living wage.

A

whopping 45% of Hispanics earn less than the living wage. As

well as 34% of women, 21% of men, and 34% of African Americans, and

-of course- countless illegal Immigrants, who

should not be here in the first place, but -as our Government

knows- they are here, and they are human, and their (soon to

be American) children are feeling the terrible misery, many getting

scarred for life. |

| The Economic Policy Institute has stated

that even this minimum living wage covers only about 60% of the

cost of basic needs, such as housing, transportation, child

care, and decent health care. |

|

|

|

Tipped employees in Hawaii may receive

$0.20 less per hour. I do not think that is fair, because a tip is a

tip, and shall not be construed as wages. I agree -though- that taxes

should be paid on those tips. Actually, Hawaii is very generous,

because the National Labor Standards calls for only a guarantee of a minimum

wage of $2.13 for tipped employees.

| I have been there! I am a Telecommunications

Engineer, but in 1998 we had an economic crisis in the family, and -my wife

and I- we had to work both for a few weeks as waiters in Florida's

restaurants. Tips did not cover

the minimum wage. Totally unfair! What a terrible

experience! We did it for a few weeks, but many people are enslaved

like this for years. |

| Fortunately, at the time, we had not children with

us. I just can not figure how waitresses -or tipped employees in

general- with dependent children can work at all at those miserable

rates. And then have time to come home to cook, and give

"quality time" to their children. |

| Then we wonder, why Americans do not have enough

children, and have to go abroad to adopt? Or why should we allow a

constant flow of young Immigrants (many of them with minimum education)

from underdeveloped countries? (where children are at plenty).

Well, it is either that, or there will not be enough young people working to

sustain the Social Security of a growing retired community by 2025. |

|

|

Some might think that the Fair Labor Standards Act

was passed in 1776, just a few days after the signing our independence from the

British. Sorry to disappoint you! Our country -on social issues- has always lagged far behind

Europe. And I mean FAR!!!

It was not until 1938 after the Depression (when

many employers were taking advantage of the tight labor market to subject workers to horrible conditions

and impossible hours) that the FLSA was passed. Shame on

us!

The FLSA is one of the most complex laws of the workplace,

it has been amended many times. It is full of exceptions and exemptions, some

of which seem to contradict one another. It allows poor

immigrant farm-hands to work for less than $2 (and no social services

provided to their families). We treat our pets a lot better than

that. Shame on us, again!

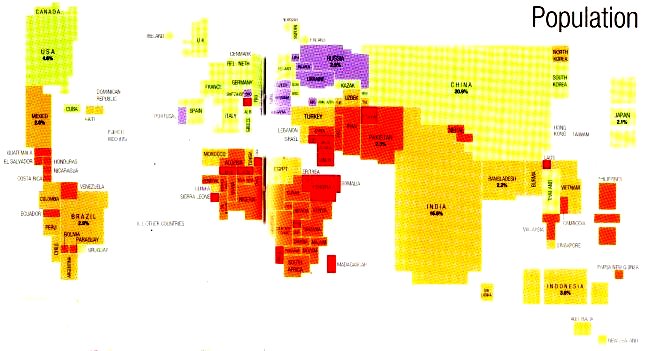

I hope you agree with me that our national standards on minimum wages is

not adequate. Some of you might be surprised to know that some States have higher

standards (such as California or Hawaii -in green color).

But the there are also some other States (such as Texas -in

brown color), were the standard is lower than the national (on that case

the Federal rate applies). And then there are other States (such as

Florida -in yellow)

where we do not even bother to have a State minimum wage standards. (please,

see table below). |

|

|

|

I grew up in Europe, where we knew we would never have the material

resources, and the economic power of the USA. Most European

countries knew they could not offer their citizens an "American

standard of living". Therefore, they instead opted for giving protection

to the workforce. They passed socialistic measures protecting individuals

and families. I would honestly say, speaking in general terms, that

Europeans have less -and smaller- material things, but they have a much greater

"quality of family

life" than we do. Notice that I have not said

"quality of life", because -for instance- traffic bottlenecks

in some cities are quite strangulating, and air pollution in some population centers

is unbearable.

In America we thought those socialistic measures could be very taxing

to our industries, and -no question- they are a drag! No

reason to lie, social services are not cheap. Services such as:

| better and longer unemployment benefits, |

| job security, |

| maternity leave (90 weeks in Sweden -that is 2

years- versus 6 weeks in the USA), |

| child care provisions, |

| better minimum wages, |

| universal health care and affordable medicines, |

| adequate social security benefits, |

| and ... so on and so forth. |

But money is not all that should be counted. Protected family

environments, are what makes our societies different from a life in the

jungle. After all, are we on this planet to live in

richness, or to live a decent life? If we can have both...

great! If we have to chose one, I go with leaving decent humble

life.

|

|

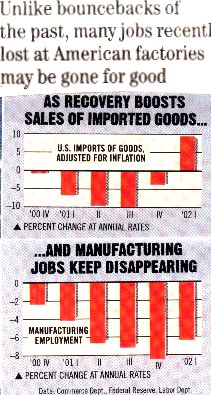

Our economic problems these days have an international scope. Do

not forget that China has 1,300 million citizens (and

growing). Having seen misery pretty close, and decimating famines for

many centuries, Chinese are willing to work -basically- for nothing, as long as

they are allowed to reside in the cities, rather than scraping a living on the

country side of mainland China. Beware, we might be for a longer

recession than told.

|

In the US, we focused on Reaganomics, that is, protecting

businesses hoping that they would generate more jobs, and they would self-impose

on them generous benefits for their employees. At best, it worked

for a few years, depending to whom you ask for opinion. Let me say, that

when it comes to trusting the self-imposed generosity of employers in general, I

feel more comfortable being a skeptic. People tend to be egocentric by

nature, and well-to-do Americans will try to rationalized why they should pay to protect

others. Unless -of course- they are the worse-off "others".

On Business Week (7/2/01, page 26, written by Laura

D'Andrea Tyson) I read that ....

The top 20% of earners

receive more than 66% of tax-deduction benefits on IRAs, yet 75%

of them enjoy employer-provided pension plans (versus 18% for the rest

of earners) , and 80%

employer-provided health insurance (versus 28% for the rest).

Moreover, since more than 80% of

high school graduates from the richest 20% of families attend college,

upper income families (who would send their children to college anyway)

benefit disproportionately from tax credits and deductions for college

tuition.

A

recent study by the Congressional Budget Office shows that during

the last 20 years, average real after-tax income stagnated around

$11,000 for the bottom 20% of earners, while the top 20% enjoyed

a 50%

increase. And the top 1% enjoyed a 157%

increase."

The article in Business Week ends with an excerpt from

Barbara Ehrenreich, who in her recent book (Nickel and Dime: On

(Not) Getting By in America") says:

"America's working poor

are the true philanthropists in our society. Working for less than

they can live on, involuntarily sacrificing the quality of their own

lives and those of the rest of their families for the rest of us.

As a nation we should be ashamed of ourselves". I could not agree more !!

|

|

So, let's protect our workers, even at the risk of slowing business growth

somewhat. This being said not by an ignorant person, but by an

experienced Engineer -with Master studies in Business Administration- who has

been an Entrepreneur several times, and who has always graduated on the top 5%

of his class.

I am not anti-business, I am pro-people, that is

different!

There are too many

families out there who are really hurting!

I need your vote! |

|

|

When clicking a button takes you to my other political

website ("progress of campaign" at www.Xuna.com

, please remember to come back to www.Gr8St8.com

by clicking the "page back" button of your browser. Thanks!

|

Editor: JX |

|